● International remittance to Bitcoin Kimchi Premium skyrocketed?…Emergency Bank (Yonhap News, April 14, 2021) https://www.yna.co.kr/view/AKR20210414015900002?input=1195m

International remittance to Bitcoin “Kimchi Premium” skyrocketed?…Emergency Bank | Yonhap News (Seoul = Yonhap News) Bank Team=Recently related to profit-making transactions using so-called “Kimchi Premium” phenomenon where bitcoin prices are higher than other countries…

The main contents of the above article are as follows.

Overseas remittances related to arbitrage using the so-called “Kimchi Premium,” in which bitcoin traded on domestic virtual asset exchanges is higher than other countries, are rapidly increasing. The banking sector sent an official note to the first branch office regarding cryptocurrency overseas remittance, allowing customers who had no business with the bank to suddenly request remittance of U.S. dollars without evidence or foreigners to send money to other countries. However, since it is virtually impossible to filter overseas remittances related to bitcoin due to the inability to request proof documents, banks have decided to prevent suspected cases of borrowed-name remittances and distributed remittances.

Overseas remittances related to arbitrage using the so-called “Kimchi Premium,” in which bitcoin traded on domestic virtual asset exchanges is higher than other countries, are rapidly increasing. The banking sector sent an official note to the first branch office regarding cryptocurrency overseas remittance, allowing customers who had no business with the bank to suddenly request remittance of U.S. dollars without evidence or foreigners to send money to other countries. However, since it is virtually impossible to filter overseas remittances related to bitcoin due to the inability to request proof documents, banks have decided to prevent suspected cases of borrowed-name remittances and distributed remittances.

Overseas remittances related to arbitrage using the so-called “Kimchi Premium,” in which bitcoin traded on domestic virtual asset exchanges is higher than other countries, are rapidly increasing. The banking sector sent an official note to the first branch office regarding cryptocurrency overseas remittance, allowing customers who had no business with the bank to suddenly request remittance of U.S. dollars without evidence or foreigners to send money to other countries. However, since it is virtually impossible to filter overseas remittances related to bitcoin due to the inability to request proof documents, banks have decided to prevent suspected cases of borrowed-name remittances and distributed remittances.

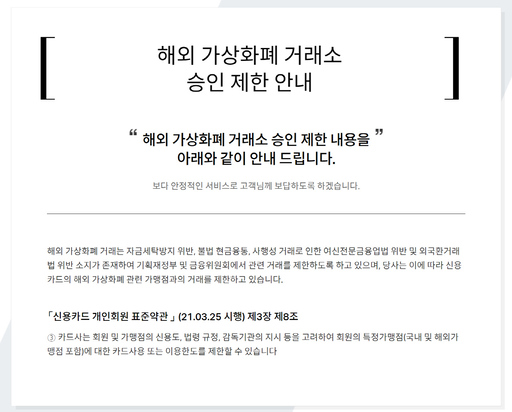

If you buy bitcoin with a credit card, you will have to pay for it without going through the bank. However, the following are the reasons why it is not necessary to clearly file a foreign exchange transaction report when paying by credit card.

① When paying overseas travel expenses in a foreign country (including withdrawal of dollars, euros, yen, renminbi, etc.) (ii) When it is not necessary to file a foreign exchange transaction declaration, or when paying the settlement fee domestically.

First of all, it is clear that buying bitcoin from overseas virtual asset exchanges with credit cards in Korea is not an overseas travel expense. Therefore, if the act of purchasing bitcoin is (i) a transaction that does not require a foreign exchange transaction declaration, or (ii) a transaction that does not require a foreign exchange transaction declaration, the purchase price can be settled by credit card. In other words, if the purchase of Bitcoin does not fall under (i) and (ii), investors will have to pay for the purchase of Bitcoin by credit card after reporting it to the Bank of Korea. A comparative sentence between the risk of violation of the law and profit transactions!

First of all, it is clear that buying bitcoin from overseas virtual asset exchanges with credit cards in Korea is not an overseas travel expense. Therefore, if the act of purchasing bitcoin is (i) a transaction that does not require a foreign exchange transaction declaration, or (ii) a transaction that does not require a foreign exchange transaction declaration, the purchase price can be settled by credit card. In other words, if the purchase of Bitcoin does not fall under (i) and (ii), investors will have to pay for the purchase of Bitcoin by credit card after reporting it to the Bank of Korea. A comparative sentence between the risk of violation of the law and profit transactions!

Unsplash Photos by VadimArtyukhin

Unsplash Photos by VadimArtyukhin